- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

How to protect yourself from rising interest rates

First home buyers: Stamp duty cuts for houses worth up to $600,000

05/03/2017

Commercial property sentiment hits record high

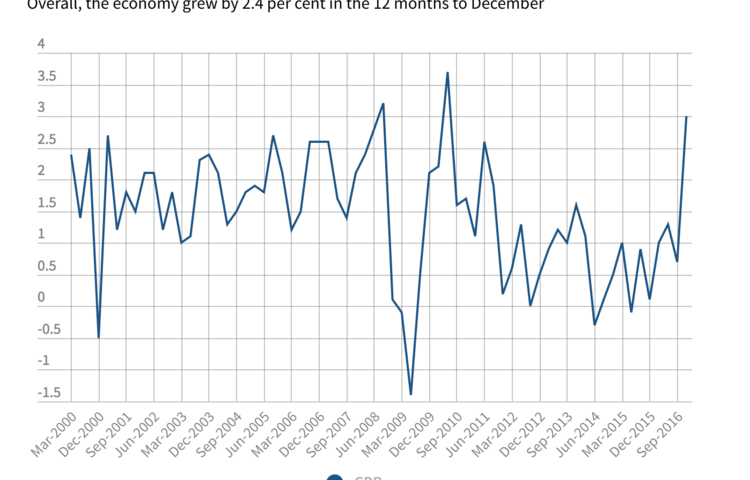

06/03/2017With lenders increasingly out of sync with the RBA, it’s no wonder people are feeling jittery about interest rates.

Since their failure to pass on the central bank’s 25 basis point cut to the official cash rate in August last year, many have been upping rates, with the result that the gap between the rate set by the RBA and interest rates offered by lenders is growing.

The easiest way to protect yourself against the increasing costs is to factor in a rise when you first take out your loan.

A Mozo analysis found the disparity between the two increased over 2016, and by year’s end major bank margins on $300,000 had grown 10 basis points higher than the RBA’s cash rate cuts.

It’s easy to become stressed about the prospect of rising interest rates, but there are methods of protecting yourself. Photo: supplied

So while we all wait with baited breath every month for the RBA’s cash rate announcement at its monthly board meeting, it’s becoming a pointless exercise. We should be putting our own banks under the microscope instead.

The cash rate has been on hold since September and should stay steady, but interest rates imposed by lenders are expected to keep rising this year.

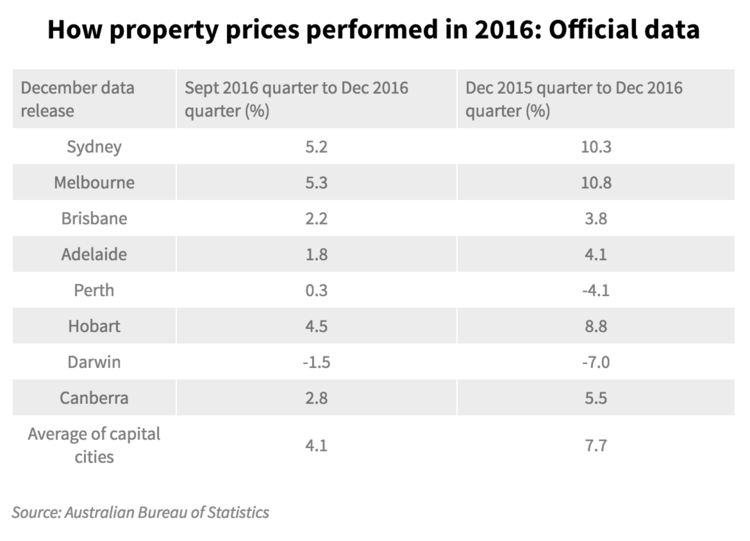

The record-low interest rates we’ve been experiencing in recent years have made money cheap, and that’s given many a helping hand in exiting the rental market and jumping into home ownership, especially with prices continuing to shoot up.

But the danger is that some have been borrowing money without factoring in a rate rise. While interest rates might not reach the double-digits seen by previous generations, they can’t stay low forever, and indeed they’re already heading north.

The easiest way to protect yourself against the increasing costs is to factor in a rise when you first take out your loan so you know your budget can be stretched to cover higher repayments.

Your lender will do this for you in assessing your application but you should be conscious of it too. Otherwise you can run into trouble down the track, with even the smallest rise putting pressure on your hip pocket.

Another option is to fix your loan, or at least part of it, so you have the security of knowing exactly what your payments will be every month – and that you can meet them.

Fixing requires some faith, as no matter how hard you look, your crystal ball won’t be able to tell you whether rates will rise or fall in the future.

Whether you go for fixed or variable, shop around for a good deal. There’s still competition among lenders so if your current bank won’t budge vote with your wallet and go elsewhere. The hassle could be worth the savings.

If you wake up tomorrow to find your lender has upped your rate, and you’re in a financial jam, consider selling some items around your home to give you some cash in a hurry or see if you can pick up a few extra hours at work.

But in the long-term you should always aim to have a cash buffer in case of unforeseen events. Get ahead by paying more off your loan than you need to while rates are low. After all, you never know what’s around the corner.

Source: The Age