- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

It now looks like tougher restrictions on Australian property investors will be introduced

Canada’s plan to tax foreign investors is already working

21/03/2017

ABS house price data ‘a clear sign threats in Sydney and Melbourne steadily rising’

22/03/2017It looks like tighter restrictions on Australian property investors may be on the way with the head of Australia’s banking regulator, APRA, telling markets to “watch this space”.

Speaking at a regulatory conference in Sydney on Monday, Wayne Byres, chairman of APRA, said that a combination of high and rapidly rising property prices in major cities, record household debt, slow wages growth and strong competitive pressures among lenders was creating an “environment of heightened risk”, according to Bloomberg.

“That’s a recipe in which if everyone is not careful the risk in the system is going to rise,” Fairfax Media reported separately.

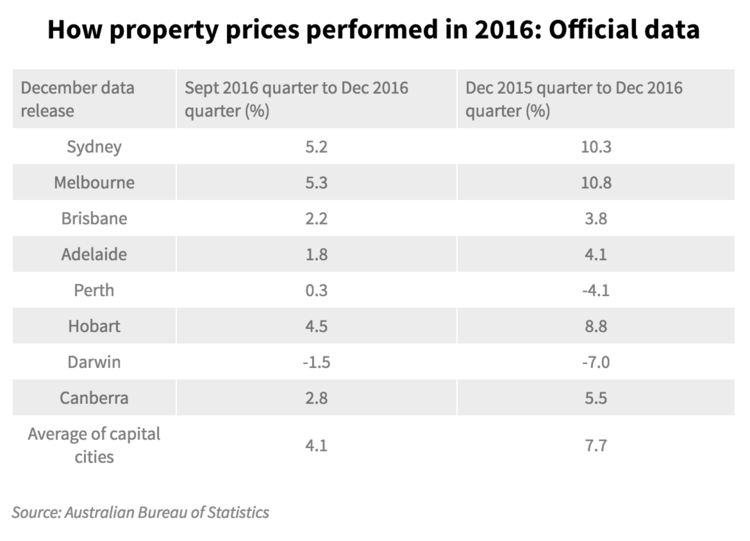

In particular, Byres described house prices in Sydney, Australia’s largest and most expensive housing market, as “high” and “rapidly rising”, fitting with recent data released by CoreLogic that revealed the median dwelling price in the city rose by close to 19% in just the past 12 months.

Many believe that the increased prevalence of investor activity in the Sydney market, and to a lesser degree Melbourne, were partially responsible for the sharp lift in house prices.

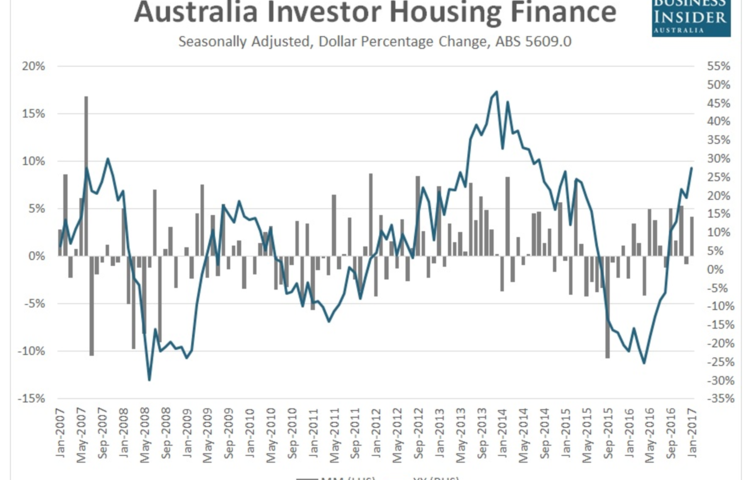

According to data released by the ABS earlier this month, lending for housing investment soared by 4.2% to $13.784 billion in January, the largest monthly total since May 2015.

The figure was 27.5% higher than the levels of a year earlier, and was the strongest growth since January 2015, the month after APRA introduced its 10% annual cap on investor borrowing.

Separate data released by the RBA said that housing investor credit increased by 6.6% in the year to January, below APRA’s annual 10% cap but a significant acceleration on the levels reported in mid-2016.

In response to the noticeable lift in investor activity seen over the second half of last year and in early 2017, Byres said that regulators role was “to make sure the banking system is resilient and that lending standards are sensible in an environment of heightened risk”.

And it appears that investors, as was the case in late 2014 when APRA introduced a 10% annual cap on credit growth to this component, may be in the sights of the regulator again.

When asked what form a potential crackdown on banks would take, Mr Byres referred to his 2014 letter to lenders which identified investment loans, interest-only mortgages and buyers with high loan-to-value-ratio loans as high risk areas.

“They are the things that remain on the radar,” Byres said, according to Fairfax.

Those remarks followed similar views expressed by Australian treasurer Scott Morrison last week.

“We’ve been looking at these issues on the investor side — on the demand side — quite significantly,” he said following a meeting of the Council of Financial Regulators.

“That is the appropriate place for that discussion to take place.

“They’ve done it before wisely and it’s for them to take any further action that they see as necessary.”

The recent acceleration in house prices, partially in response to heightened levels of activity from investors, have also been on the radar of Reserve Bank of Australia.

In the bank’s March monetary policy statement, the bank said that “supervisory measures have contributed to some strengthening of lending standards”, seemingly a step back from the more confident tone expressed just one month earlier when it said “supervisory measures have strengthened lending standards and some lenders are taking a more cautious attitude to lending in certain segments”.

That caught the eye of several prominent private-sector economists who said that the tweak in language indicates that the bank, working alongside APRA, may be pushing for tighter lending restrictions, referred to as macroprudential tools.

Those views were bolstered further last week when Michele Bullock, RBA assistant governor of financial systems, said that the “initial effects on credit and some other indicators we use to assess risk may fade over time,” adding that the RBA is “continuing to monitor their ongoing effects and are prepared to do more if needed”.

The introduction of tighter macroprudential restrictions, should they arrive, may also provide the RBA more policy flexibility when it comes to the outlook for Australian interest rates.

Speaking in late February, RBA governor Philip Lowe said that he’d like to see Australian unemployment a bit lower and inflation a bit higher, although, instead of lowering interest rates to expedite that outcome, he suggested that further cuts “would probably push up house prices a bit more, because most of the borrowing would be borrowing for housing.”

“While that would have some positive effect on the economy, the issue we are dealing with internally is how that would add to fragility,” he said.

Given recent remarks from the regulator, central bank and federal treasurer, coupled with continued strong house price growth in Australia’s southeastern capitals and increased investor activity, it now appears that the ducks are lining up for even greater lending restrictions.

Like members of the US Federal Reserve earlier this month when they launched a coordinated verbal response to firm up expectations of a rate hike in mid-March, the remarks from local policymakers could be seen to be preparing the market for tighter lending restrictions.

Indeed, the question in many people’s minds now is not whether it will occur, but when and what form they will come in.

Source: Business Insider Australia