- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

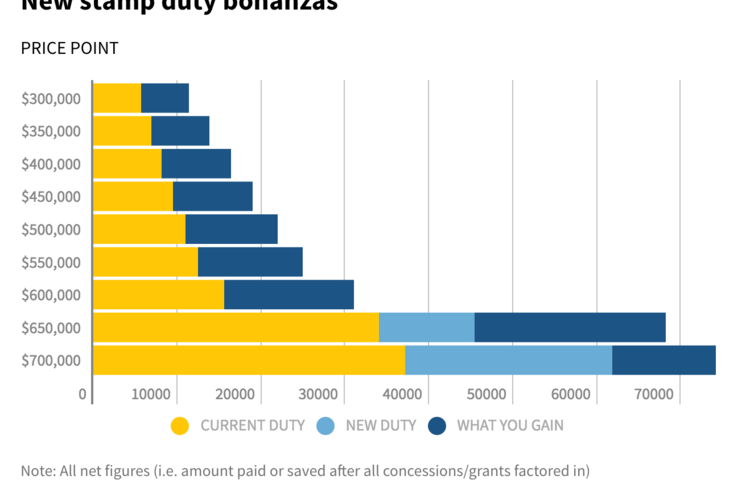

First home buyers: Stamp duty cuts for houses worth up to $600,000

First Homeowner Grant to double in regional Victoria

04/03/2017

How to protect yourself from rising interest rates

06/03/2017Tens of thousands of first home buyers will no longer have to pay stamp duty on properties worth up to $600,000 under an Andrews government plan to make housing more affordable.

Long-awaited reforms to be unveiled on Sunday will give new home owners savings of up to $15,000 by exempting them from stamp duty on new and existing properties, in a bid to help more Victorians to break into the expensive housing market.

A $50 million pilot program will also give about 400 people the chance to co-purchase a dwelling with the government, which will offer to take an equity share of up to 25 per cent for each property – in turn reducing the deposit that a first home buyer would otherwise pay.

The so-called “HomesVic” program will begin in January next year, targeting couples earning up to $95,000 and singles earning up to $75,000. Buyers will need a 5 per cent deposit to be eligible, and when the property is sold, the government will recover its share of the equity.

“First home buyers are facing more hurdles than ever,” said Premier Daniel Andrews. “They’re battling rising prices, they’re competing against investors and they’re up against federal government policies that advantage existing owners. These changes will help level the playing field.”

The stamp duty exemptions are the latest in a suite of housing affordability reforms announced in recent days, including doubling the First Home Owner Grant in regional Victoria and the creation of 17 new suburbs in Melbourne’s key growth zones.

The government says the exemption, which starts on July 1 this year, will benefit about 25,000 first home buyers every year, resulting in an average of $8000 worth of savings for new or existing homes.

Essentially it means that someone buying an established home worth $600,000 will no longer have to pay the $15,535 stamp duty that currently applies; buying a $450,000 established home will no longer require $9485 in stamp duty fees; while buying an established home worth $300,000 will save $5685 through stamp duty exemptions.

The Sunday Age can also report:

First home purchases ranging between $600,000 and $750,000 will get a concession applied on a sliding scale.

First home buyers of new houses will still be eligible for the first home owners grant, thereby boosting the support they receive.

The stamp duty exemption will apply to new and existing homes (including houses, townhouses, apartments and off-the-plan dwellings) that cost under $600,000 and are lived in for at least 12 months (i.e. Investment properties are not eligible).

The changes will be announced by Mr Andrews and Treasurer Tim Pallas on Sunday, and are likely to be welcomed given the growing number of people who are finding it more difficult than ever to get into the housing market.

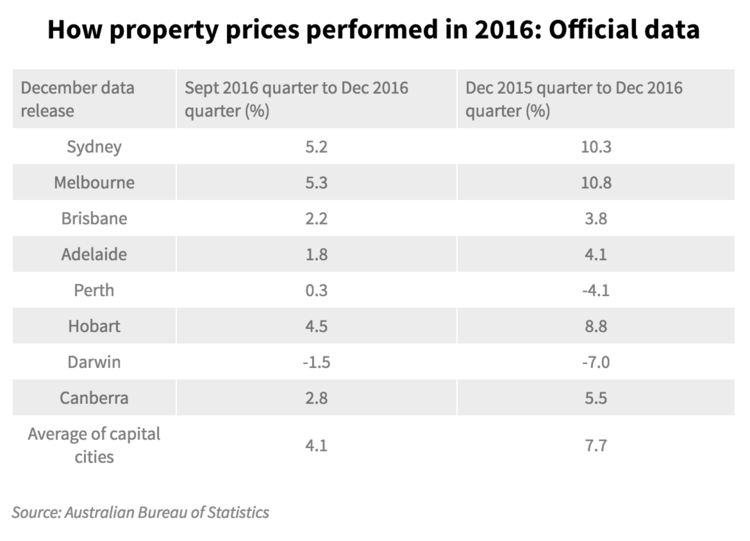

But with Melbourne’s median house price now at a record $795,447, according to the Domain Group, some will argue that home ownership will remain out of reach for far too many unless property prices are driven down, or initiatives such as inclusionary zoning are introduced, forcing developers to ensure that a proportion of new dwellings are affordable or low-cost.

Mr Pallas said the changes were an “important step towards ensuring today’s families and future generations will be able to afford somewhere to live”. He said the HomesVic pilot program would also make it easier for people “to get their foot in the door, as well as reduce the size of the loan they’ll need to service”.

A similar program is offered in Western Australia, known as “KeyStart” – although the housing authority in that state takes up to 30 per cent of the equity share.

The state government will also contribute $5 million to Buy Assist, a community-sector based shared equity scheme.

Source: The Age