- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

The 10 words that may signal a gathering storm for housing investors in Australia

There’s no housing bubble in Australia, heads of big four banks say

09/03/2017

Increased pressure on Federal Budget to use taxes to help first-home buyers

10/03/2017“Supervisory measures have contributed to some strengthening of lending standards.”

This 10-word sentence from the Reserve Bank of Australia (RBA) on Australia’s housing market in its March monetary policy statement could signal something important.

It seems to be a step back from the more confident tone expressed just one month earlier when it said “supervisory measures have strengthened lending standards and some lenders are taking a more cautious attitude to lending in certain segments”.

“Some” strengthening. Like many of our report cards from school, that sounded like code for “could do better”.

In an otherwise fairly bland policy statement, it was one of the few changes that created a talking point.

Does “could do better” mean tighter macroprudential policies to slow the housing market may be on the way, coming on top of the 10% annual cap on investor credit growth implemented by Australia’s banking regulator, APRA, in late 2014.

As this chart from Citibank shows, while the annual cap initially slowed investor activity when it was first introduced, that trend reversed in 2016, perhaps in response to the two rate cuts delivered by the RBA and concern over proposed changes to negative gearing concessions should Labor have taken office following Australia’s federal election.

PMA Finance

Even before Tuesday’s policy statement was released, Bill Evans, Westpac’s well-respected chief economist, suggested that tighter lending restrictions were likely. And now, in the wake of the RBA’s latest tweak, it seems that other economists are now warming to that view.

“It’s possibly a sign that more macro prudential measures to slow property market investment may be on the way,” said Shane Oliver, chief economist at AMP Capital.

Scott Haslem of UBS agreed, suggesting that “this raises the possibility of more macro-prudential policy in the future”.

They’re not alone.

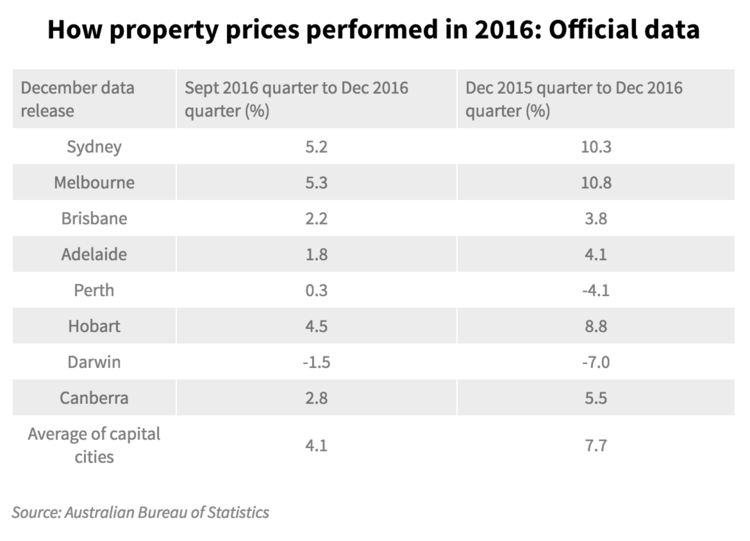

Almost as quickly as house prices in Sydney and Melbourne have risen — the very reason additional measures are being discussed — so too have the numbers who think that APRA, in consultation with the RBA, will tighten restrictions further, specifically towards investors.

PMF Finance

Craig Williams, Brendan Sproules and Andrew Tam, equity researchers at Citibank, share the view that further regulatory intervention is likely, noting that recent commentary from Australian regulators, along with the OECD and ratings agency Standard and Poor’s, suggests that concern over financial instability is growing.

“Recently, two prominent global agencies, OECD and ratings agency S&P have raised significant concerns about the financial stability of the Australian economy from the strength of the housing market,” they say.

“Both institutions highlight the inherent risk in the economy that a house price retracement may have on household consumption and a resultant surge in mortgage defaults.”

And they believe there have been several instances recently that suggest Australian regulators — APRA, ASIC and the RBA — are also becoming concerned about the continued property market surge.

“ASIC has brought civil proceedings against Westpac for failing to properly assess whether potential borrowers could repay their home loans. This is despite a lack of customer losses from these practices and the alleged practices no longer forming part of current policy or practices,” they say.

They also note that APRA has also advised banks that their books are too heavily concentrated to property lending, and suggest that the regulator has also “pulled some banks aside” to slow investor lending before they hit the 10% cap and triggering the need to apply penalties.

And RBA governor Philip Lowe has also expressed a reluctance to cut rates further given his concerns that it will only fuel growth in housing credit and house prices, seemingly an admission that Sydney and Melbourne’s housing markets are preventing the bank from easing policy further to boost inflation and lower unemployment, two of its three policy mandates.

When it looks like a duck and quacks like a duck, it is a sign that further policy restrictions are on the way?

APRA wouldn’t be alone in implementing even stricter measures to cool the exuberance of home buyers, with the likes of Hong Kong, New Zealand and Singapore all adopting a similar staggered approach in recent years.

Citi thinks that if tighter measures are introduced as they have been elsewhere, they will likely be centred around loan serviceability and a curtailment in investor activity.

Some of the possible policy responses floated by Citi are shown in the chart below.

pma finance

No one really knows whether they or other measures will be required, perhaps aside from the regulators of course, and a lot will depend on the evolution in house prices and investor housing finance in the months ahead.

Markets will get some further clarification on that front on Friday when the ABS releases updated housing finance data for January.

The markets, policymakers and prospective housing investors will not doubt be watching closely.

Source: Business Insider Australia