- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

Australian housing markets ‘defy belief’ but bank warns against knee-jerk policy reactions

How would rising interest rates affect property prices?

15/03/2017

The foreign investor myth that’s fooled us all

16/03/2017The Sydney and Melbourne housing markets are continuing to “defy belief” but banks have warned that government measures designed to address affordability could actually drive up prices.

National Australia Bank chief economist Alan Oster said property prices were showing no signs of slowing, despite growing concerns about affordability two months out from the federal budget.

The analysis from NAB shows median dwelling prices have climbed up to nine times higher than gross household incomes in Sydney and seven times higher in Melbourne on the back of surging investor demand.

“The housing markets in Sydney and Melbourne continue to defy belief,” said Mr Oster.

The Turnbull government is looking to arrest the country’s housing affordability crisis by canvassing measures aimed to help people on the demand side of the market. These measures include allowing struggling buyers to only pay up to 70 per cent of a mortgage; creating a housing finance corporation for low-income households; and allowing access to superannuation for a deposit.

The measures are being considered in tandem with the government’s central strategy: radically increasing supply across the east-coast market.

“There is a real risk that some measures could have the unintended consequence of pushing prices higher,” said Mr Oster.

On Tuesday, the superannuation industry fired back at suggestions from Assistant Treasurer Michael Sukkar that first home buyers could use part of their superannuation to purchase a house if it was part of a broader policy mix.

“Withdrawing superannuation savings to buy a house, especially when house prices appear to be at the high end of the cycle in the major states, will not help first home buyers into the market. It will only further fuel the increase in house prices,” said Financial Services Council CEO Sally Loane.

CoreLogic head of research Tim Lawless said despite record low rental yields, investor demand remained high, suggesting investors are likely to be relying on a negative gearing strategy to compensate for their losses.

Housing finance figures from the Australian Bureau of Statistics released on Friday showed that investors now make up more than 50 per cent of new mortgages across NSW.

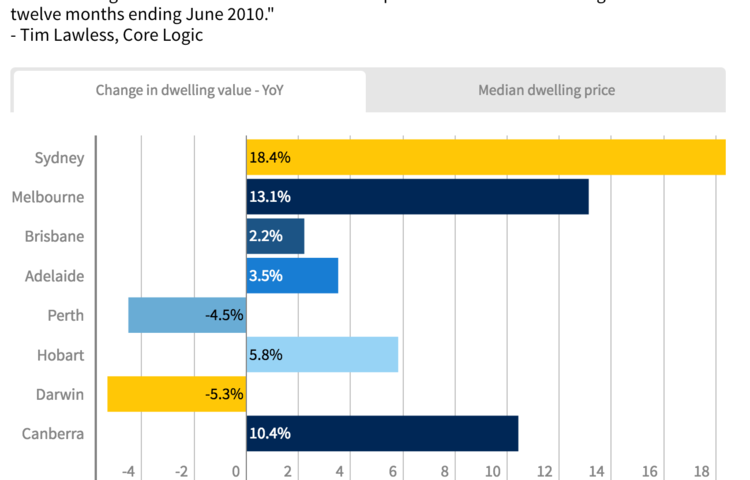

Figures released by Core Logic on Wednesday show Sydney and Melbourne have remained at the top of the capital gain tables since 2009. During that time, dwelling prices in Sydney have risen by 105 per cent and Melbourne by 88 per cent. Canberra had the next-highest rise with 37 per cent.

“It also indicates that investors are speculating on future capital gains,” said Mr Lawless before foreshadowing a potential slowdown similar to the early 2000s.

“In Sydney, where the annual rate of growth is now 18 per cent, this is the highest annual growth rate since the 12 months ending December 2002 when the housing boom of the early 2000s started to slow,” said Mr Lawless.

Mr Oster said the Reserve Bank was becoming increasingly focused on financial stability and the NAB had now adjusted its expectations of a quarter of a per cent rate cut at the end of 2017 over concerns it would further fuel house prices.

“We now consider a further rate cut [in 2017] as unlikely in this environment,” he said.

Source: The Age