- Suite 17 / 79 Manningham Road, Bulleen VIC 3105

- 0406 197 099

- hello@pmafinance.com.au

National Australia Bank raises variable, investors’ home loan rates

The foreign investor myth that’s fooled us all

16/03/2017

ANZ: Asian currencies will weaken further against the US dollar

17/03/2017National Australia Bank will tap the brakes on a resurgent investor market by hiking interest rates on variable home loans for property investors, while also increasing rates for owner occupiers.

The bank will lift the variable interest rate on owner occupiers’ loans from 5.25 per cent to 5.32 per cent, and on residential investment home loans from 5.55 per cent to 5.80 per cent, from next Friday.

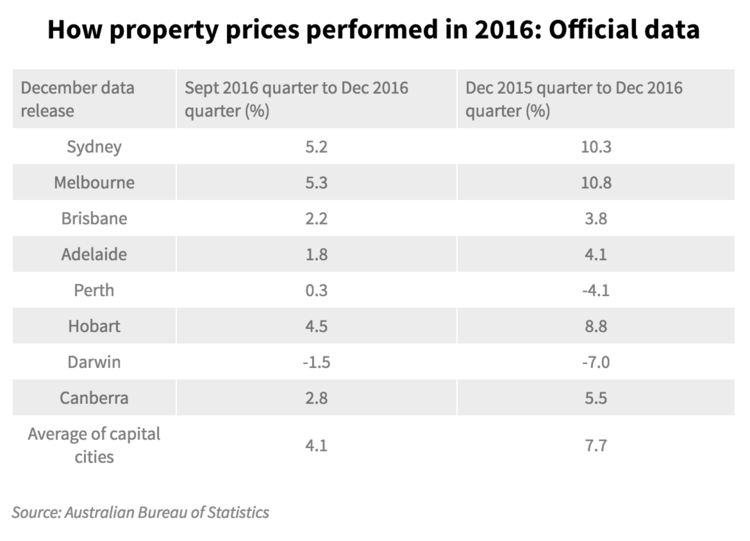

“Clearly the investor market is seeing very strong levels of demand across Australia, particularly in Sydney and Melbourne,” NAB chief operating officer Antony Cahill said.

“We’re taking this decision now proactively to ensure that we do get the right returns but we put the right price in place to be a responsible lender.”

Last week, it emerged that investor borrowers had surged to account for more than half of home loans taken out in January, the highest figure since the Australian Prudential Regulation Authority brought in measures in 2015 to curb lending to landlords.

And the Reserve Bank’s assistant governor (financial systems) Michele Bullock this week said the the central bank was considering tightening lending standards to cool the housing market.

Mr Cahill said NAB was well within the banking regulator’s 10 per cent limit on investor lending growth, but wanted “flexibility” going forward, accounting for any regulatory changes and moves by the bank’s competitors.

Variable rates for owner occupiers were being increased in part due to fierce competition and increased regulation and funding costs, Mr Cahill said.

He said mortgage rates remained at low levels and NAB was confident that borrowers would be able to make the increased repayments.

The bank has cut its fixed interest rate for first-home buyers from 3.98 per cent to a record low of 3.69 per cent for fixed two-year loans.

Commonwealth and ANZ said they would not comment on future interest rate movements and Westpac said its rates were always under review.

Source: The Age